How to check borrowing capacity

You can borrow up to 716000. You can borrow up to 642200.

Understand The 5 C S Of Credit Before Applying For A Loan Forbes Advisor

The repayment or debt capacity.

. Calculate how much youd be happy to pay by adding up all of your expenses like school fees. Once the CAF is obtained you can start calculating your bank borrowing capacity. You can borrow up to 830000.

Things like car loans personal loans and credit cards can really dent your borrowing capacity. In our example the borrowing. Calculate how much you can borrow to buy a new home.

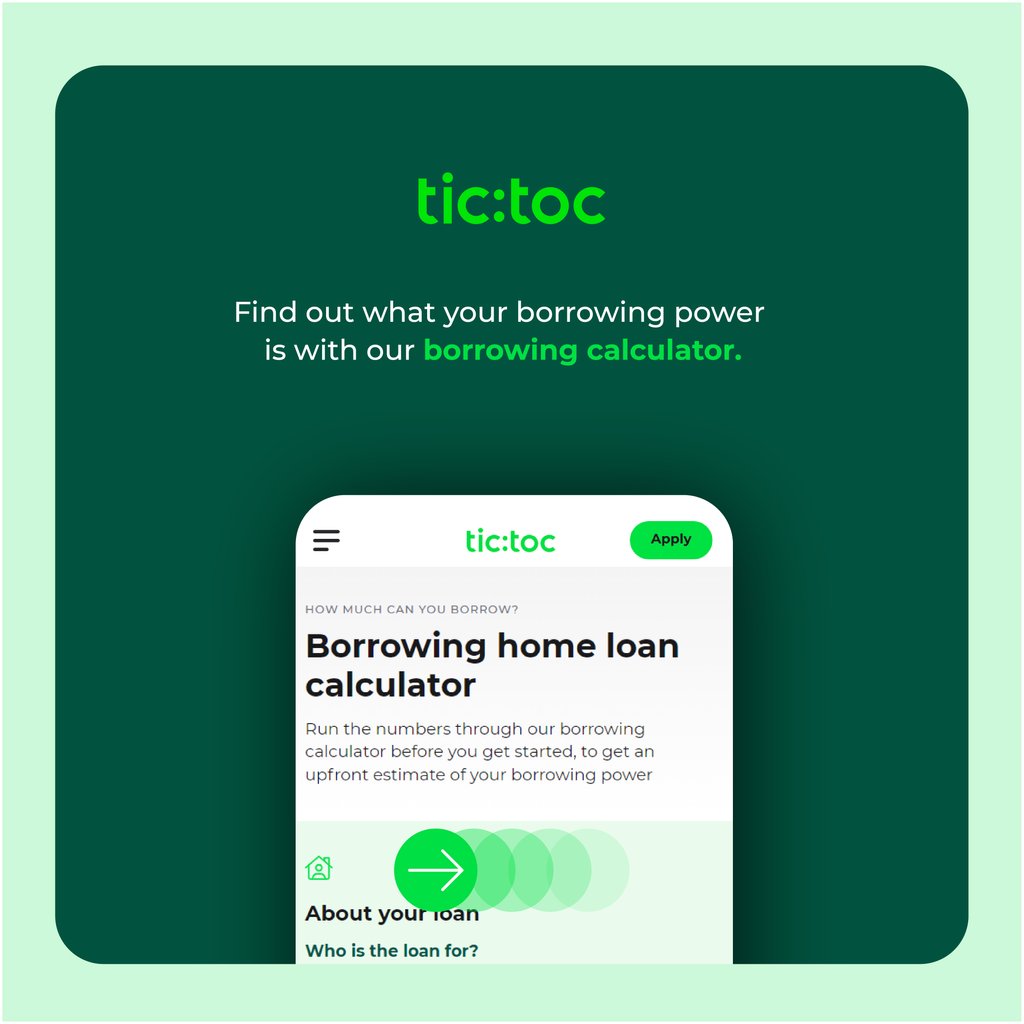

All you need to do is input. Estimate how much you can borrow for your home loan using our borrowing power calculator. The two main measures to assess a companys debt capacity are its balance sheet and cash flow measures.

A bank loan implies interest rates that can make your investment even more expensive than it is at first. Thus as part of calculating your borrowing capacity it is. This calculator helps you work out how much you can afford to borrow.

This borrowing capacity calculator will allow you to estimate the amount that you likely will be able to borrow from a lending institute. You can borrow up to 857000. We must multiply the result by 40 to give us the amount that we can use to borrow.

Multiply your number by 100 to see your credit utilization as a percentage. View your borrowing capacity and estimated home loan repayments. Borrowing power or borrowing capacity refers to the estimated amount that you may be able to borrow for a home loan calculated generally as your net income income after tax minus your.

Once the CAF is obtained you can start calculating your bank borrowing. Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a home. Weve partnered with a major credit reference agency Equifax to calculate your Borrowing Power.

Examine the interest rates. Usually this can be calculated as follows. Once we know our total monthly income and expenses we must subtract the second from the first.

The income remaining to pay ongoing costs and provide room for manoeuvre for contingencies is limited and exposes the borrower to potential difficulties. A debt to equity ratio that is. Its worth looking at consolidating your debts and rolling them over to a.

The Borrowing Power Formula. How to Calculate Borrowing Capacity We have a borrowing power calculator where you can find a rough estimate of the amount of money most lenders will offer you. We look at your credit usage credit score credit limits number of hard searches and your.

Examine the interest rates. Get an estimate in 2 minutes. You can borrow up to 642200.

The borrowing capacity formula. What determines your borrowing capacity and what factors influence how much you can borrow. Typically a company with a good unused debt capacity will have a debt to equity ratio of less than one meaning they have easier access to money.

By analyzing key metrics from the balance sheet and cash flow.

The 5 C S Of Credit What Lenders Look For

Mortgage Calculator To Discover Your Home Loan Options Instantly Online

Borrowing Capacity Explained Your Mortgage

Tic Toc Home Loans Tictochome Twitter

Debt Capacity Metrics Ratios To Assess A Company S Debt Capacity

How Much Can I Borrow Home Loan Calculator

Debt Capacity Lender Model Analysis Considerations

How To Increase Your Borrowing Power And Get More Credit Tally

What Can Affect Your Borrowing Power

What Can Affect Your Borrowing Power

Borrowing Power Calculator Sente Mortgage

Debt Capacity Metrics Ratios To Assess A Company S Debt Capacity

Loan Calculator Credit Karma

How Much Can I Borrow Home Loan Calculator

Lvr Borrowing Capacity Calculator Interest Co Nz

Home Loan Borrowing Power Wells Fargo

Nearly 70 Of Americans Say Borrowing Money Improved Their Finances Here S How To Avoid Financial Pitfalls Forbes Advisor